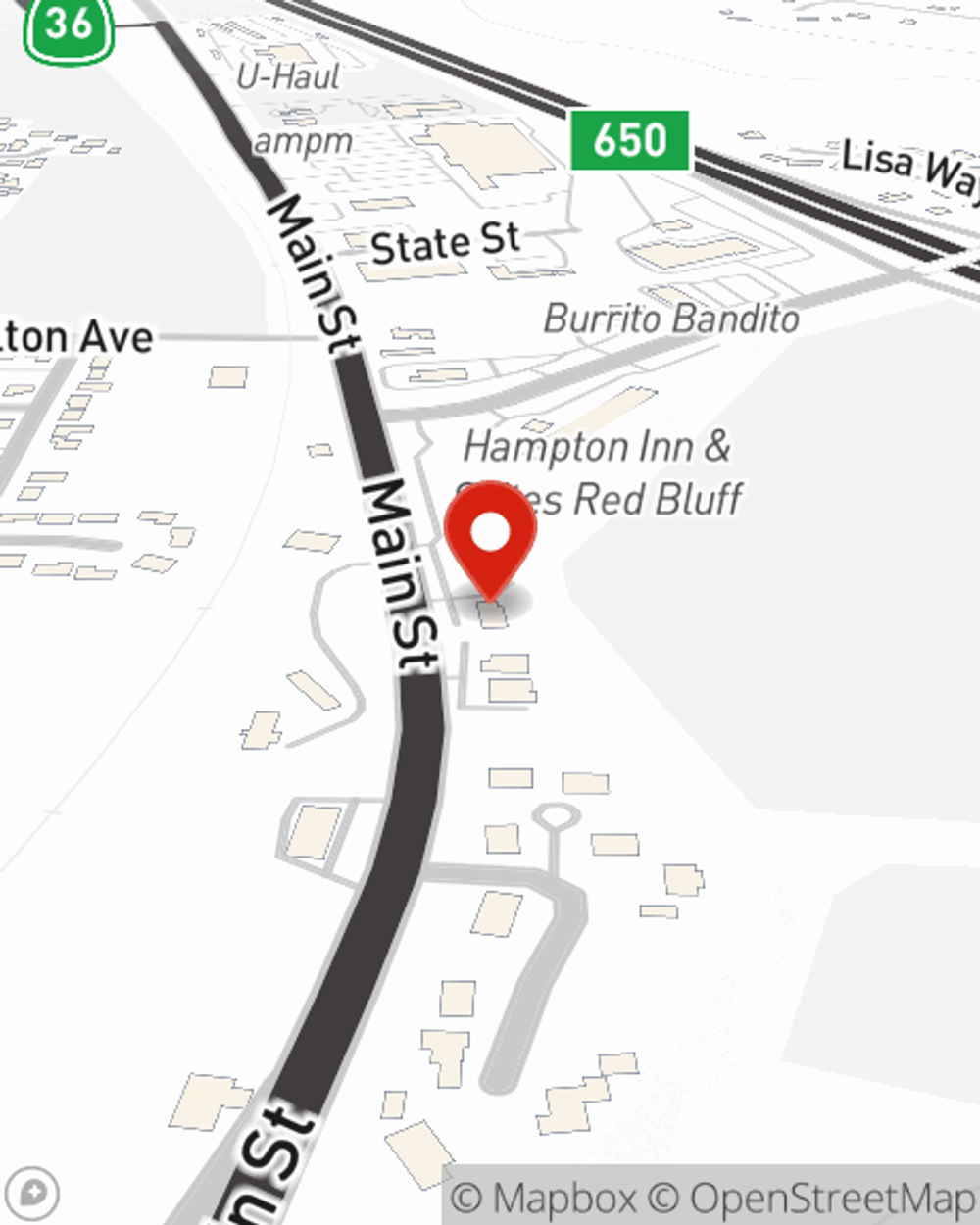

Renters Insurance in and around Red Bluff,

Your renters insurance search is over, Red Bluff,

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Even when you rent a place to live you still have plenty of responsibility. You want to make sure what you own is protected in the event of some unexpected trouble or catastrophe. And you also need liability protection for friends or visitors who might stumble and fall on your property. State Farm Agent Hector Garnica is ready to help you navigate life’s troubles with high-quality coverage for your renters insurance needs. Such considerate service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If mishaps occur, Hector Garnica can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

Your renters insurance search is over, Red Bluff,

Renters insurance can help protect your belongings

Protect Your Home Sweet Rental Home

The unpredictable happens. Unfortunately, the possessions in your rented townhome, such as a coffee maker, a smartphone and a desk, aren't immune to abrupt water damage or vandalism. Your good neighbor, agent Hector Garnica, has a true desire to help you understand your coverage options and find the right insurance options to insure your precious valuables.

Renters of Red Bluff,, State Farm is here for all your insurance needs. Get in touch with agent Hector Garnica's office to get started on choosing the right coverage options for your rented apartment.

Have More Questions About Renters Insurance?

Call Hector at (530) 527-9922 or visit our FAQ page.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.

Hector Garnica

State Farm® Insurance AgentSimple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.